Over the last few decades, societies have been successful in the management of “conventional risks”. Conventional risks are not highly complex (however often complicated to understand), they are not highly interconnected with other types of risks and they can be effectively managed by technical and organizational measures. For instance, if one takes the example of Germany, the number of fatal accidents at works decreased from almost 5,000 in 1960 to less than 500 in 2014; the number of traffic accidents from 22.000 in 1972 to 3,700 in 2014, the number of fatal heart attacks and strokes decreased from 109 cases per 100,000 to 62 in the time period between 1992 and 2002.

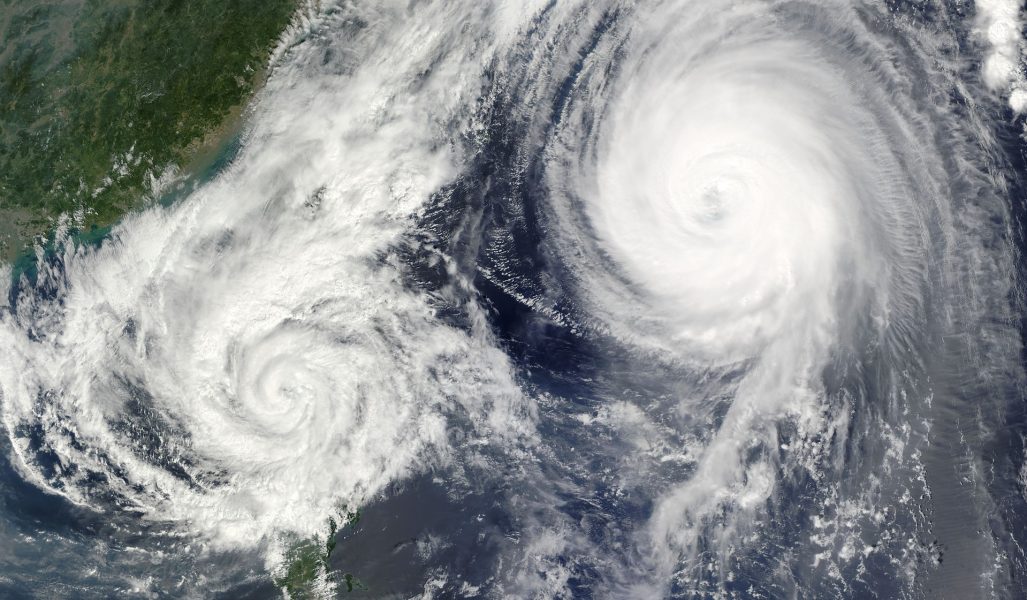

However, overcoming the globally interconnected, non-linear risks, such as by those posed, for example, by climate change or the global financial system and the closely related growing inequality between rich and poor, is not very straightforward. Systemic risks pose serious challenges for risk assessment and risk management because they are not amenable to the reductionism of the standard risk assessment model. They require a more holistic approach to hazard identification, to risk assessment, and to risk management, because they are complex, stochastic and non-linear.

A recent Essay written by three experts in the field, Klaus Lucas (Institute of Technical Thermodynamics, Aachen University, Germany), Ortwin Renn (Institute of Advanced Sustainability Studies, Germany), and Carlo Jaeger (Global Climate Forum) published in Advanced Theory and Simulations provides a review of how insights form complexity science can be applied to the domain of systemic risks. They have identified four major properties of systemic risks: they are (1) transboundary in nature, (2) highly interconnected and intertwined leading to complex causal structures and dynamic evolutions, (3) non-linear in the cause-effect relationships showing often unknown tipping points or tipping areas and (4) stochastic in their effect structure.

Systemic risks tend to be underestimated and do not attract the same amount of attention as catastrophic events. The authors have tried to use the many insights from complexity science to provide a framework for systemic risk analysis.

This interesting Essay is freely accessible on Wiley Online Library!